Inclusion of shipping in the EU Emissions Trading Scheme (EU ETS)

Context & objectives

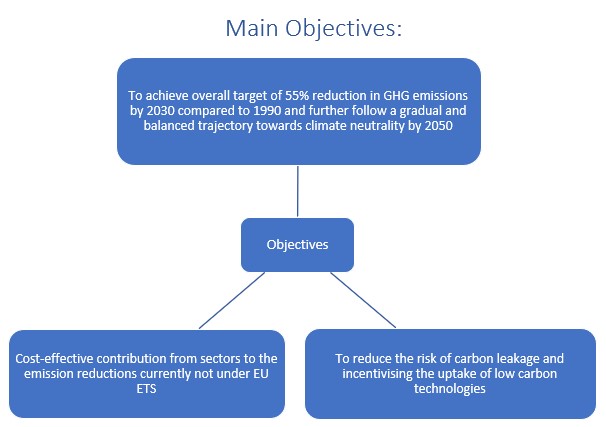

Today, emissions from maritime transport are higher than in 1990 and are expected to grow further. In order to be consistent with the increased level of climate ambition, the EC proposed to extend EU ETS to maritime transport, along with action agreed within IMO. Under the Paris agreement reducing maritime transport emissions is part of the EU economy-wide reduction commitment. Emissions from maritime transport are expected to grow by around 34% between 2015 and 2050 and would undermine reductions made by other sectors to combat climate change.Consequently, as part of its Fit for 55 package, the European Commission proposed to amend the EU Emission Trading System Directive (2003/87.EC) in order to include emissions from ships. To ensure a smooth transition, a "phase in" period is introduced during which shipping companies would have to surrender allowances for a portion of their verification emissions, gradually rising from 20% in the first year to reach 100% in the fourth year.

Members of the European Parliament have voted to extend the scope of the EU Emissions Trading Scheme to the shipping industry and trialogue negotiations to finalize ETS reforms are on-going.

Summary of key points

- One Member State Administration should be responsible for each shipping company.

- Shipping companies will have to report aggregated EU MRV emissions for their fleet; verified aggregated emissions will have to be submitted to their responsible administering authority before 31 March each year.

- In accordance with the "polluter pays principle", shipping companies (or another entity duly appointed by them) will have to purchase and surrender EU carbon allowances before 30 April each year.

- The commission will consider the possible alignment of the EU ETS for maritime transport if an equivalent regime is proposed by the IMO.

Required allowances for EU MRV emissions till 2026

The emissions for which allowances must be surrendered will be calculated based on the following rules :

- 100% of Emissions for voyages between EU ports.

- 100% of Emissions at berth in a port under the jurisdiction of a Member State.

- 50% of Emissions for Extra – EU voyages. (to/from EU ports) till 2026 and expected to include 100% emissions after that.

An ocean fund will be created to support Europe’s maritime sector in its decarbonization using 75% of the generated revenue from the auction of maritime emissions allowances.

Carbon leakage linked to re-routing and evasive port calls present a hurdle in maintaining transparency in reporting. To combat this, the commission needs to set up a monitoring scheme and propose measures.

Failing to comply with the requirements of the directive will lead to bad publicity, penalty, obligation, and consequent expulsion order.

EU ETS applied to THETIS EU MRV data

The rules proposed by the EU in terms of Required allowances that have been applied to the yearly emissions reported for the years 2018, 2019, and 2020 are available from EMSA THETIS MRV. The following conclusions have been reached regarding the quantity of EU Allowances (EUAs) required (assuming a surrendering rate of 100% of verified emissions):- 2018: 145 million tCO2 emitted & 101 million of EUAs required

- 2019: 147 million tCO2 emitted & 105 million of EUAs required

- 2020: 128 million tCO2 emitted & 88 million of EUAs required

Read more about the EU ETS

Read the proposal for amending Directive 2003/87/EC establishing a system for GHG trading